Is Safer Better?

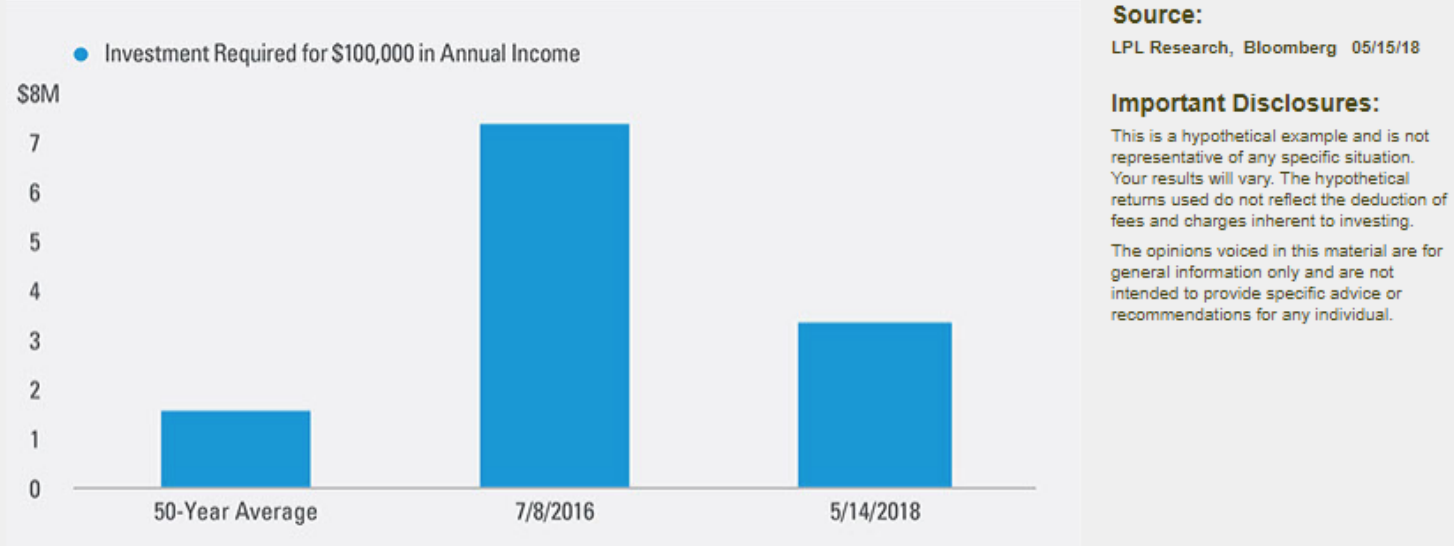

Submitted by Majerko Investment Management LLC on August 14th, 2018I came across this chart that I thought I would share. It is nothing I didn’t know, but seeing it on paper is rather really illuminating. Sure, putting your money in Treasuries seems safe from a credit stand point, but there is a cost with today’s rates so low. At the current rate on 10 year Treasuries of around 3 % return, you would need approximately 3.3 million dollars to generate a 100,000 dollars of income a year. A tall task indeed for most! Not to mention potential interest rate risk.

What to do?

My recommendation is to allocate a portion of your investments to Stocks to get more potential growth. Yes, they will be more volatile, which of course is part of the deal.

How much in Stocks vs Bonds?

It depends on several of your personal factors i.e. income needs, risk tolerance, age etc. But over allocating to low yielding Treasuries might not be the best way to go in the current environment.

*Disclosure: The opinions voiced in this material are for general information only and are not intended to provide specific advice for an individual. The economic forecasts may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indices are unmanaged and may not be invested into directly.

Stock investing involves risk of principal.